The Financial Quants and Engineers club will develop students' technical skills and network at the intersection of quantitative finance and technology. Members will work on a variety of projects within data science, risk analysis, quantitative modeling, and algorithmic trading. The main goal of the organization is to provide the necessary exposure and skills for students to gain roles in quantitative fields. FQE regularly hosts seminars, organizes discussions with leading professors, and offers opportunities for members to work on innovative projects, providing valuable hands-on experience. Our goal is to empower the next generation of quants to lead and innovate in the ever-evolving landscape of finance and technology.

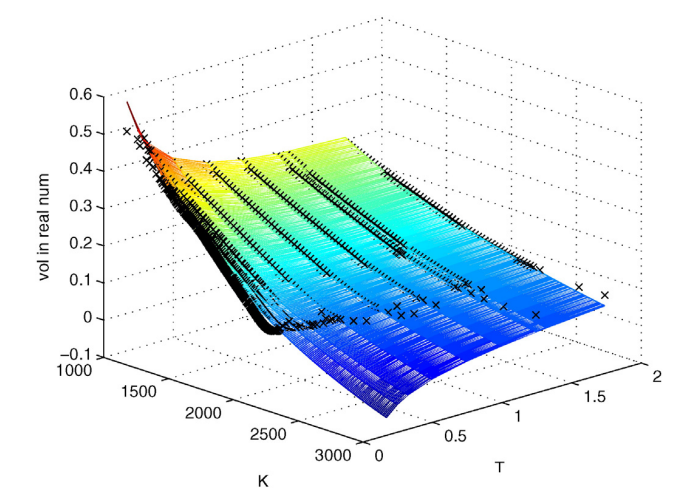

We construct a methodology that offers a quick way for option market makers to update their theoretical values for options in real-time. We use an Unscented Kalman Filter (UKF) to quickly calibrate the implied volatility surface parameterization, which replaces the need for a costly objective function that needs to be minimized, allowing for real-time updates of the volatility surface.

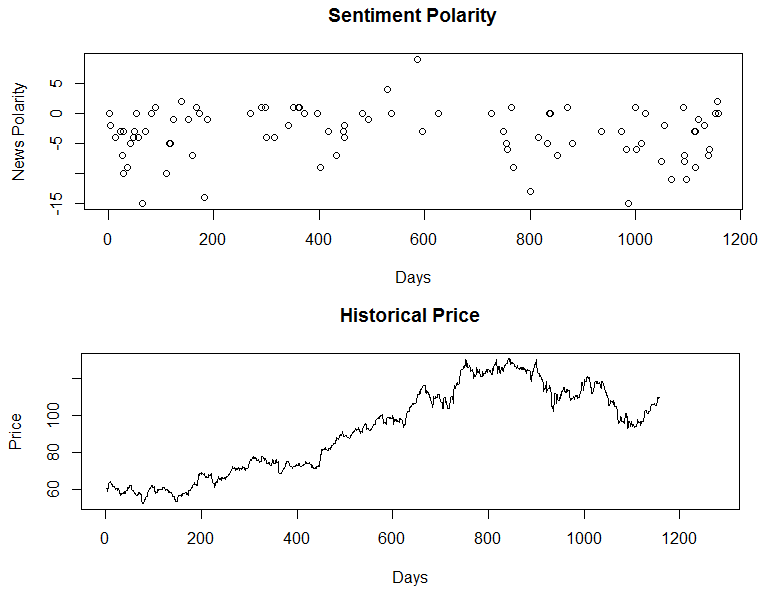

This project aims to predict stock price movements by integrating sentiment analysis of Twitter posts, financial news articles, and Kalshi event contract names with historical stock data. By quantifying public sentiment overall and toward specific stocks, we seek to uncover patterns and correlations that influence market dynamics. A Long-Short-Term Memory (LSTM) neural network will model temporal dependencies within the combined sentiment metrics and stock prices.