The Financial Quants and Engineers club will develop students' technical skills and network at the intersection of quantitative finance and technology. Members will work on a variety of projects within data science, risk analysis, quantitative modeling, and algorithmic trading. The main goal of the organization is to provide the necessary exposure and skills for students to gain roles in quantitative fields. FQE regularly hosts seminars, organizes discussions with leading professors, and offers opportunities for members to work on innovative projects, providing valuable hands-on experience. Our goal is to empower the next generation of quants to lead and innovate in the ever-evolving landscape of finance and technology.

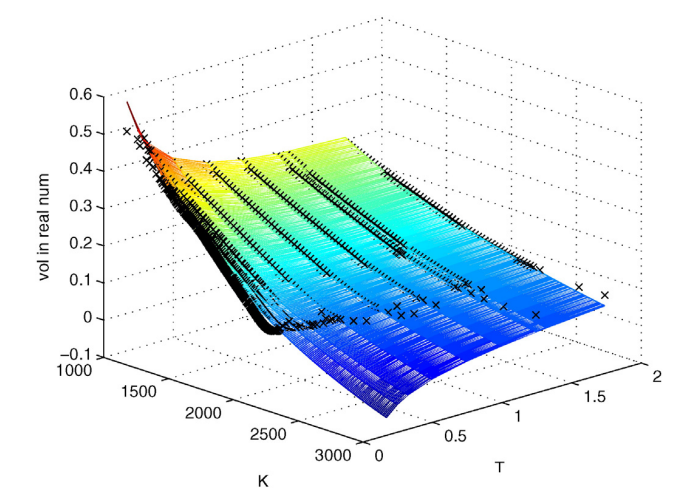

We construct a methodology that offers a quick way for option market makers to update their theoretical values for options in real-time. We use an Unscented Kalman Filter (UKF) to quickly calibrate the implied volatility surface parameterization, which replaces the need for a costly objective function that needs to be minimized, allowing for real-time updates of the volatility surface.

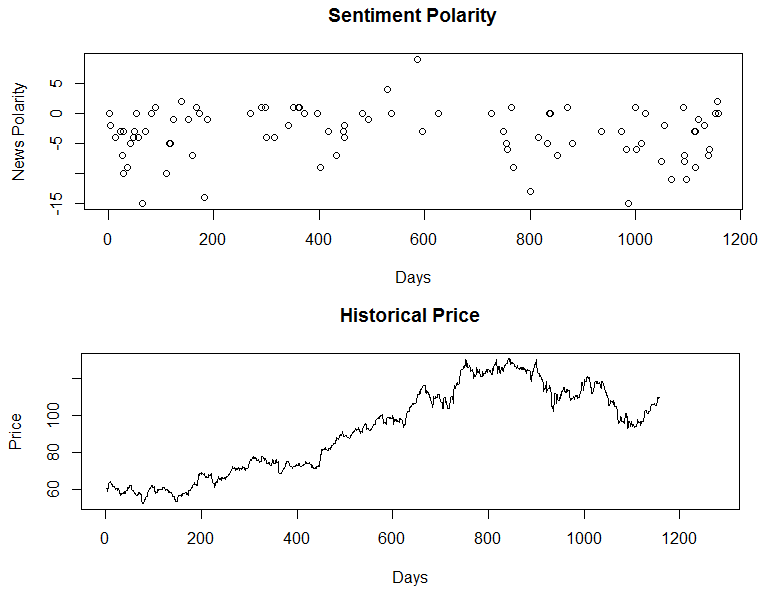

This project aims to predict stock price movements by integrating sentiment analysis of Twitter posts, financial news articles, and Kalshi event contract names with historical stock data. By quantifying public sentiment overall and toward specific stocks, we seek to uncover patterns and correlations that influence market dynamics. A Long-Short-Term Memory (LSTM) neural network will model temporal dependencies within the combined sentiment metrics and stock prices.

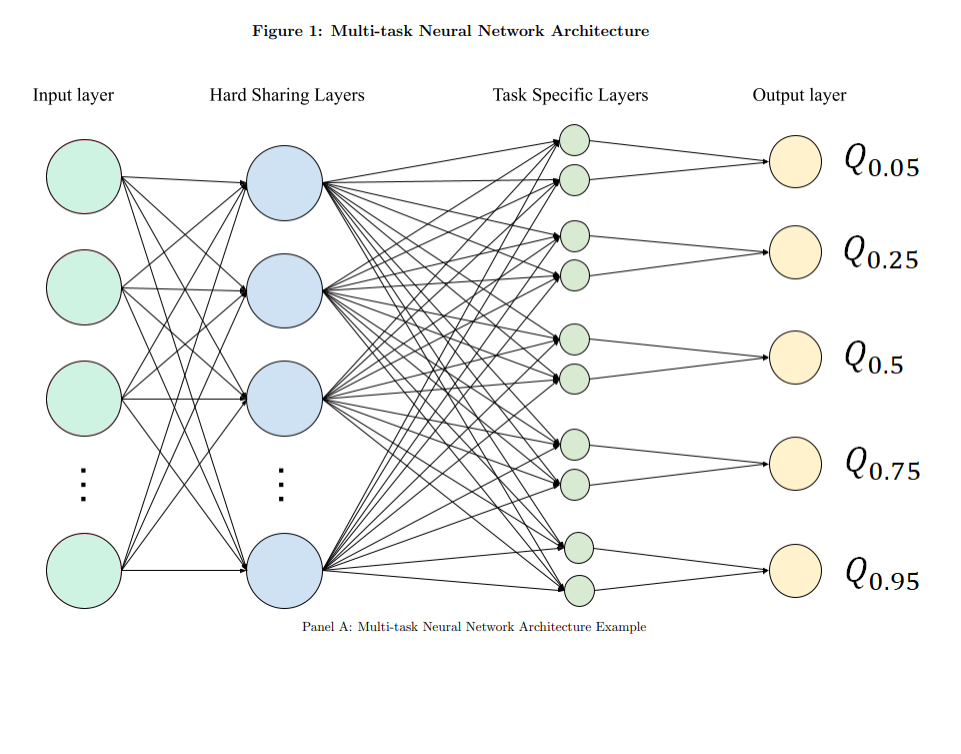

The Quantile Machine Learning Project inspired by Fred Liu's “Quantile Machine Learning and the Cross-Section of Stock Returns” is a multi-task neural network designed to predict the cross section of equity returns. We gathered 150+ equity factors from Chen and Zimmerman’s open source cross sectional asset pricing library and replicated the datasets used that are not updated in real time through the WRDS database’s Compustat daily updates such that the trading strategy could be implemented in a real time setting. We use Chen and Zimmerman’s open source factor library to train the multi-task neural network of monthly US equity returns with a rolling window for training and validation sets and begin the out of sample testing in year 2000. Each year proceeding sorts the expected monthly returns into deciles in which we implement a standard long-short portfolio by longing the 10th decile and shorting the 1st to capture the premium implied by the factors. We include an additional constraint upon sorting the expected returns such that all expected returns are calculated assuming you are executing a market order to ensure our portfolio’s expected returns are realistic after costs. The results of our findings exceeded the original paper’s findings with a Sharpe ratio of 2.1 after transactions costs from the period of 2000 to 2023 due to the increase in information provided from additional factors beyond Jeremiah green’s factor library that was originally used in Liu (2023).

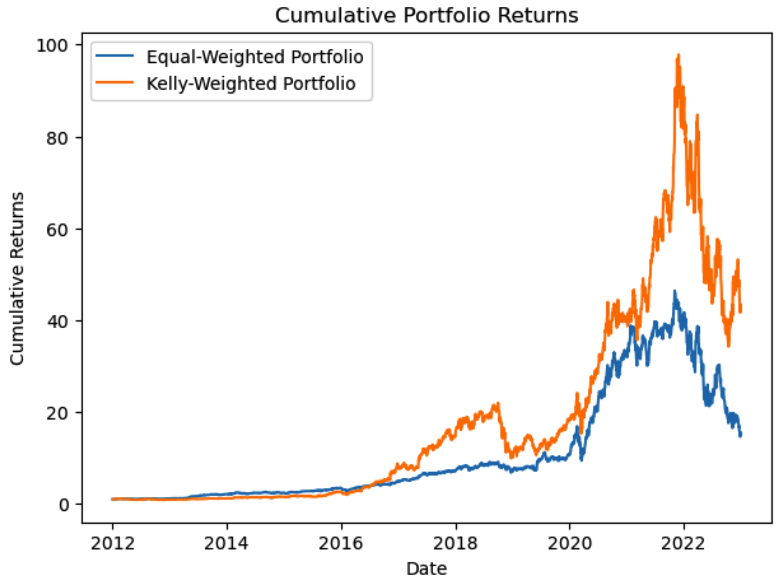

The Kelly Project extends the Kelly-criterion for optimal portfolio sizing to a practical setting by incorporating both non-normal and correlated returns to solve for optimal weighting in a portfolio of assets that don’t exhibit behaviors assumed by traditional portfolio sizing methods. We use historical stock returns of the assets in our portfolio along with a Cholesky Decomposition to simulate correlated stock returns via Monte Carlo. We use historical stock returns to estimate the distribution of returns for stocks in our portfolio via a Kernel Density Estimator (KDE). We apply a Cholesky Decomposition to simulate correlated returns across all of the individual stocks in our portfolio, and estimate the joint probability distribution using a gaussian mixture model to solve for the optimal Kelly weights. The resulting portfolio beats the benchmark (equally weighted portfolio) in terms of both risk-adjusted performance (Sharpe ratio) and annual return (compound annual growth rate).

President

Vice-President

Treasurer

Secretary

Data Officer